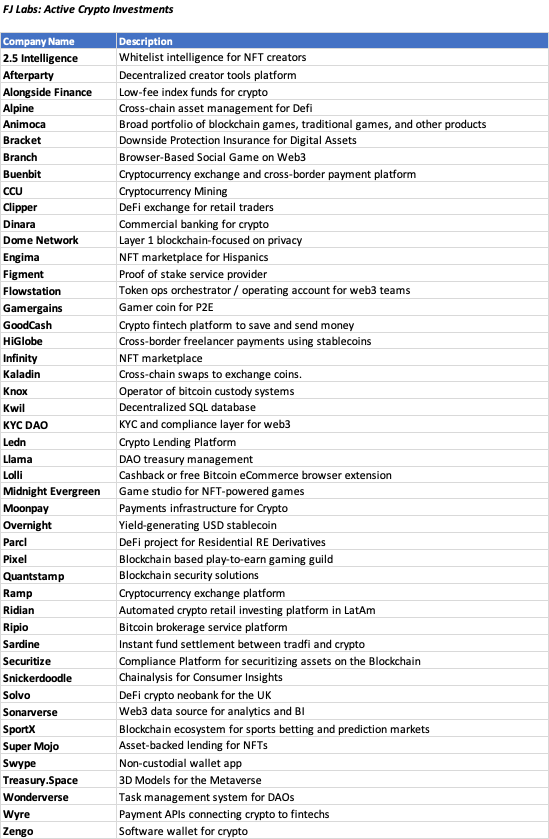

People do not realize how active FJ Labs is in the crypto/Web3 space. We are investors in 47 companies and are investing in both equity and tokens in up-and-coming crypto projects. In this post, I want to present how we became involved in crypto. In upcoming posts, we will cover our crypto strategy and our thoughts on crypto marketplaces.

As I articulated in my 2017 post Some thoughts on cryptocurrencies, my interest in crypto came from my exposure to Argentina with its repeated crisis. Being an avid gamer with powerful GPUs, I mined BTC out of intellectual curiosity in the early 2010s. Unfortunately, I did not take any of this particularly seriously and lost 100% of the BTC I ever mined as I did not remember where I stored them. I am pretty sure I lost more BTC than I currently own. Fortunately, I bought some on BitStamp which I managed to sell before the last bubble burst in 2017.

I was fortunate to read the tea leaves well enough to get out of the liquid market in time. As I wrote at the time: “I am extremely bullish on the future of the blockchain and cryptocurrencies. However, I also believe that most of the coins in existence today will go to 0. Many of them have no fundamental reason for being. The application they support does not fundamentally require a coin. Moreover, there is a large amount of fraud and frankly ludicrous projects that have ICO’d. ICOs will not replace venture capital. Only blockchain applications are being funded by ICOs and frankly most of the companies that ICO’d would not have been funded by proper investors. What is creating the frenzy in ICOs right now is a fundamental imbalance in supply and demand. You have large crypto holders in countries like China who are looking for assets to buy, the easiest of which are other crypto currencies. That bubble will eventually burst, though I am not foolish enough to begin to pretend to know when that will happen. Bubbles tend to last longer than people “in the know” suspect. When the Internet bubble burst, hundreds of companies failed. However, they left behind the infrastructure and some of the companies that ultimately led to the Internet revolution we are still experiencing today. The current crypto bubble will also burst. It will wipe out the value of many coins and companies, but it will have funded the creation of the building blocks of future successful crypto and blockchain applications.”

At the time, we thought through what crypto marketplaces we should build or invest in, but most of the marketplaces we were presented with did not articulate well why they would benefit from decentralization and how they would use tokens to incentivize liquidity creation. In general, it felt extremely early. As a result, we ended up having an ad-hoc approach to crypto investing:

- We invested in our friends who were building crypto companies which led us to invest early in Animoca, Figment, Shipyard/Clipper, and Zengo.

- We invested thematically in megatrends we believed in. Having missed investing in the centralized exchange wave, we decided to invest in the best crypto onramps and offramps like Moonpay, Ramp and Wyre.

- We invested in many companies providing infrastructure for building crypto applications.

- We invested, tactically, in the top crypto-native funds including Multicoin and Libertus in 2017 and 2018 to get our practice off the ground and co-invest with them.

Ultimately, crypto marketplaces emerged most explosively in decentralized finance. This makes sense, as programmable finance and code-based, disintermediated financial applications were always a natural teleological conclusion to programmable money. And, in hindsight, of course the first real crypto marketplace applications to emerge were crypto native rather than replacements of existing offline marketplaces. In 2020, with the emergence of the “DeFi Summer” decentralized finance applications started growing dramatically. It turns out that DeXes like Uniswap and Sushi, lending protocols like COMP and AAVE, and even insurance protocols like Nexus Mutual are all marketplaces. They are intermediaries between providers of liquidity and those who require liquidity. The same dynamics apply as in Web2 marketplaces making our expertise highly relevant. On top of that the rise of NFTs in 2021 led to insane growth at OpenSea, another marketplace. Both trends brought our attention back to the space in a major way.

Given how early we are in the Web3 space, there is no unifying theme to our investments. We’ve been investing at the intersection of fintech and crypto, exchanges, consumerization of crytpo, NFT marketplaces, tooling and infrastructure for crypto-native teams and DAOs. Of late we have been putting a lot of thought into:

- Bringing Web2 UX/UI expertise into Web3 which is something Braintrust has done extremely well.

- Verticalizing OpenSea. OpenSea is the eBay of Web3. It has a complex user interface and is not particularly well suited for certain verticals. The same way eBay and Craigslist were verticalized in Web2, it’s easy to imagine the emersion of an amazing vertical gaming NFT marketplace, or perhaps a Zillow/Trulia meets Compass for metaverse properties, and many other vertical applications.

- Helping prepare for a cross-chain world with Layer 0s and bridges.

- Making crypto derivatives markets significantly larger than the spot markets.

All in all, to date we invested in 47 crypto companies. All that to say that crypto is now near and dear to our hearts. I will share in upcoming blog posts how crypto falls into the FJ Labs portfolio and will cover best practices for building crypto marketplaces.

If you are building something in the crypto space reach out. We would love to hear from you.

Consider web3 Reserve system by Metabook, a solution for NFT platform: we help increasing the value of selected partners’ NFTs https://www.linkedin.com/…/metaverse-format-shifting…/